Liquidity pools serve the identical objective as market makers – which is to supply market liquidity and depth to make sure customers make sooner transactions and at truthful prices. They replaced traditional order books that relied on buyers and sellers to discover out the value for exchanging two belongings. Another risk for liquidity suppliers is the potential for the sensible contract governing the pool to be exploited.

Dangers Of Coming Into A Liquidity Pool

On entry of the liquidity pool, there might be additionally an acquisition of a ‘Marren v Ingles right’ to obtain the future capital reward. The acquisition value crypto liquidity pool of this right is the estimated current worth of the lengthy run capital reward. The new HMRC DeFi steerage on lending and staking indicates that lending rewards (including these from liquidity pools) might not always be revenue rewards. It is necessary to contemplate if the character of the rewards is capital or earnings. We lay out some general considerations for this within the table beneath based on HMRCs guiding rules. Lending swimming pools are utilized in decentralized lending protocols like Aave or Compound.

Even trusted platforms like Uniswap have faced dangers regardless of audits. Different forms of liquidity swimming pools cater to various strategies in DeFi. Choosing the best one is dependent upon your danger tolerance, rewards, and the belongings concerned. Nonetheless, figuring out how they work—and how to use them—can be confusing. Many crypto merchants struggle with issues like low liquidity, impermanent loss, and choosing the right pool to earn rewards.

Yield farming is immediately tied to liquidity pools—it’s simply the subsequent step after turning into a liquidity supplier. But with larger rewards come larger dangers, including impermanent loss and good contract bugs. They permit you to swap one token for an additional based on market demand.

Xrp Clears Resistance Channel With Merchants Eyeing $233-$2Forty Zone

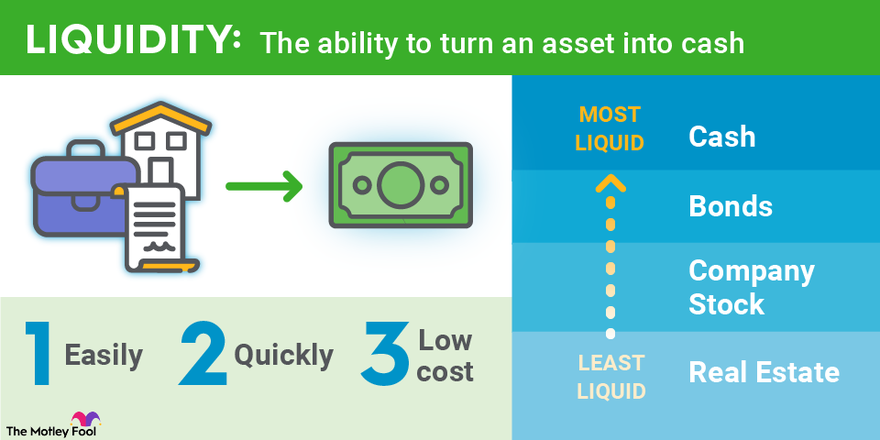

Since there’s no centralized order guide or market maker, the pool itself permits customers to swap tokens immediately. That’s what makes decentralized exchanges work while not having a conventional dealer. Liquidity swimming pools are a crucial part of the buying and selling market infrastructure. They provide the mandatory liquidity for trades to be executed and contribute to the soundness of the market. Despite the risks, they offer vital benefits for both traders and liquidity suppliers. Liquidity pools play an important role in making certain the graceful functioning of the trading market.

This is known as impermanent loss, and it’s the most misunderstood risk for model new LPs. In this information, we’ll break down liquidity pools for newbies, explain the advantages and risks, and allow you to get began with step-by-step insights. A DEX requires that a liquidity pool has a couple of token to facilitate shopping for and selling or swapping between two tokens or buying and selling pairs. For occasion, whenever you purchase token X with token Y on a DEX, the availability Fintech of token Y within the pool increases while that of X reduces. When a commerce is executed, the property are exchanged directly from the pool.

Revenue Tax On Liquidity Pool Earnings

In addition, it also rebalances applications throughout margin buying and selling, exchanges, and lending protocols. Decentralized exchanges needed to face the challenge of crypto market liquidity prior to the arrival of Automated Market Makers (AMMs). In the initial days of DEXs, they needed to depend on the order e-book model for facilitating trades. Contemplating the limited variety of patrons and sellers during that time, the order guide mannequin led to varied inefficiencies.

- Instead, users deposit assets so others can borrow them, normally overcollateralized.

- LPs add an equal value of buying and selling pairs into the pool and earn a fraction of buying and selling fees or crypto rewards.

- Decentralized exchanges had to face the problem of crypto market liquidity prior to the arrival of Automated Market Makers (AMMs).

- Some LPs earn 5–20% APY, while yield farming strategies can push that higher—but include extra danger.

- The beauty of decentralized finance is that anyone could be a liquidity supplier.

- DeFi ecosystems that make the most of liquidity pools embody decentralized exchanges (DEXs), yield farms, and crypto lending platforms, amongst others.

You stock it with snacks (cryptocurrencies) so individuals can come by and make trades. In this setup, liquidity providers are those who inventory the machine. They provide liquidity by depositing two kinds of tokens right into a pool—for example, ETH and USDC. Now that you simply perceive the importance of liquidity pools in the buying and selling market, take the subsequent step with TIOmarkets. Join our group of a hundred and seventy,000+ merchants in over one hundred seventy countries and access our complete educational assets to boost your trading expertise.

Algorithmic Swimming Pools

The great thing about decentralized finance is that anyone is often a liquidity supplier. To participate in a liquidity pool, LPs deposit an equal value of the two tokens, such as https://www.xcritical.com/ Ethereum and USDC, that comprise the pool to create a trading pair ETH/USDC. One Other noticeable example amongst top liquidity swimming pools, DeversiFi, is probably one of the fastest crypto liquidity swimming pools.